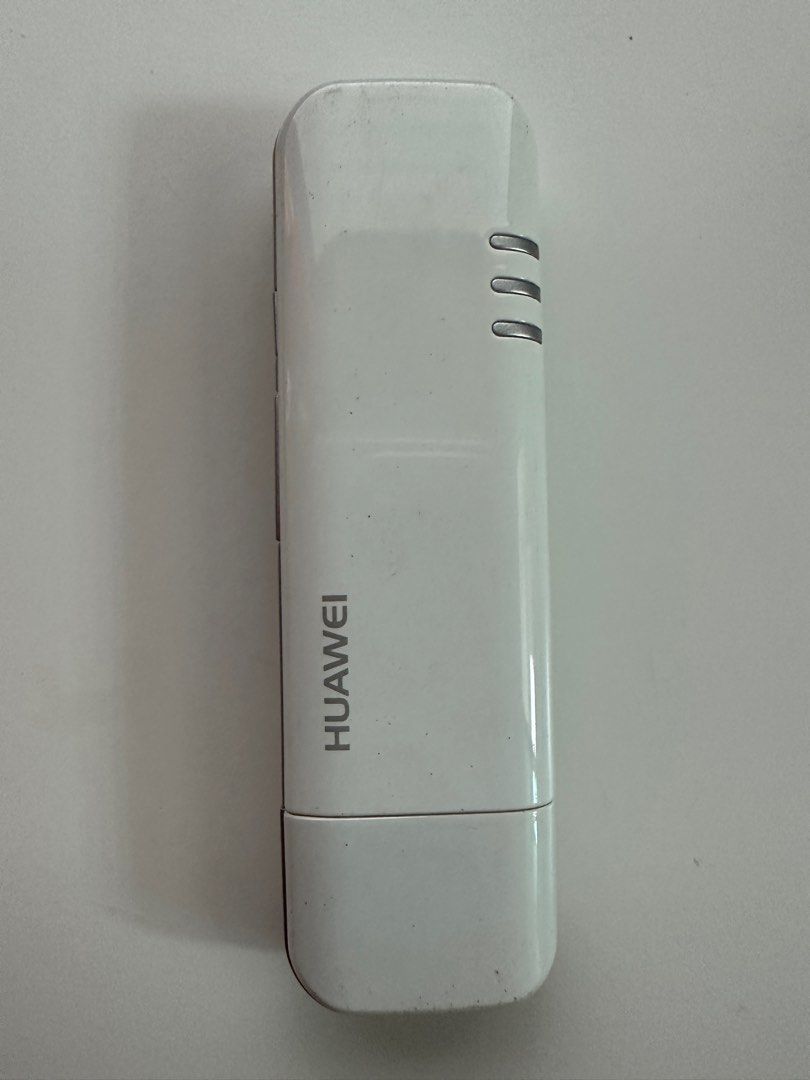

Huawei E160e Orange 3G mobile broadband dongle UNLOCKED BY KRYONET 並行輸入品 | sorrisodeartistaoficial.com.br

Huawei E160e Orange 3G mobile broadband dongle UNLOCKED BY KRYONET 並行輸入品 | sorrisodeartistaoficial.com.br

華。魏E160 3グラムワイヤレスusbモデムモバイルコネクトhsdpa usbスティックリーダーwcdma/gsm 850/900/1800/1900ないE169 _ - AliExpress Mobile

ロック解除huawei e160 e160g e160e hsdpa 3グラムモデム|modem dell|modem router 3g simmodem evdo rev a - AliExpress

Huawei E160e Orange 3G mobile broadband dongle UNLOCKED BY KRYONET 並行輸入品 | sorrisodeartistaoficial.com.br